Commandments Of Business Funding

- Proper Name

- Address (Brick and Mortar)

- Business Phone Number

- Business Email (Own Domain)

- Website/Domain /Social Media

- Apply For Business Enity

- Apply For EIN

- Open 3 Business Checking & Savings Account {National, Regional and Credit Union}

- Build Business Credit

Ready To Take The Next Step But Need Assistance Click The Link Below

GDG Ventures Is For .....

Entrepreneurs with Credit Challenge: For business owners who struggle with credit issues and want capital to expand.

Small Business Owners Seeking Growth:

Looking for ways to fund new initiatives without going through credit-heavy loan processes.

Aspiring Business Owners with Limited Capital: Learn how to access $100k+ in funding, even if you don't have established credit.

Self-Starters Looking for DIY Funding:

Avoid costly middleman fees and take control of your business funding journey.

Business Building E Books

-

The Money Resource Vault: Verified Ways People Fund, Start, and Work”

Regular price $16.99 USDRegular price -

Verified & Visible: How to Claim and Control Your Business on Google

Regular price $9.99 USDRegular price -

Built to Get Funded: How to Structure Your Business So Money Finds You

Regular price $0.00 USDRegular price

-

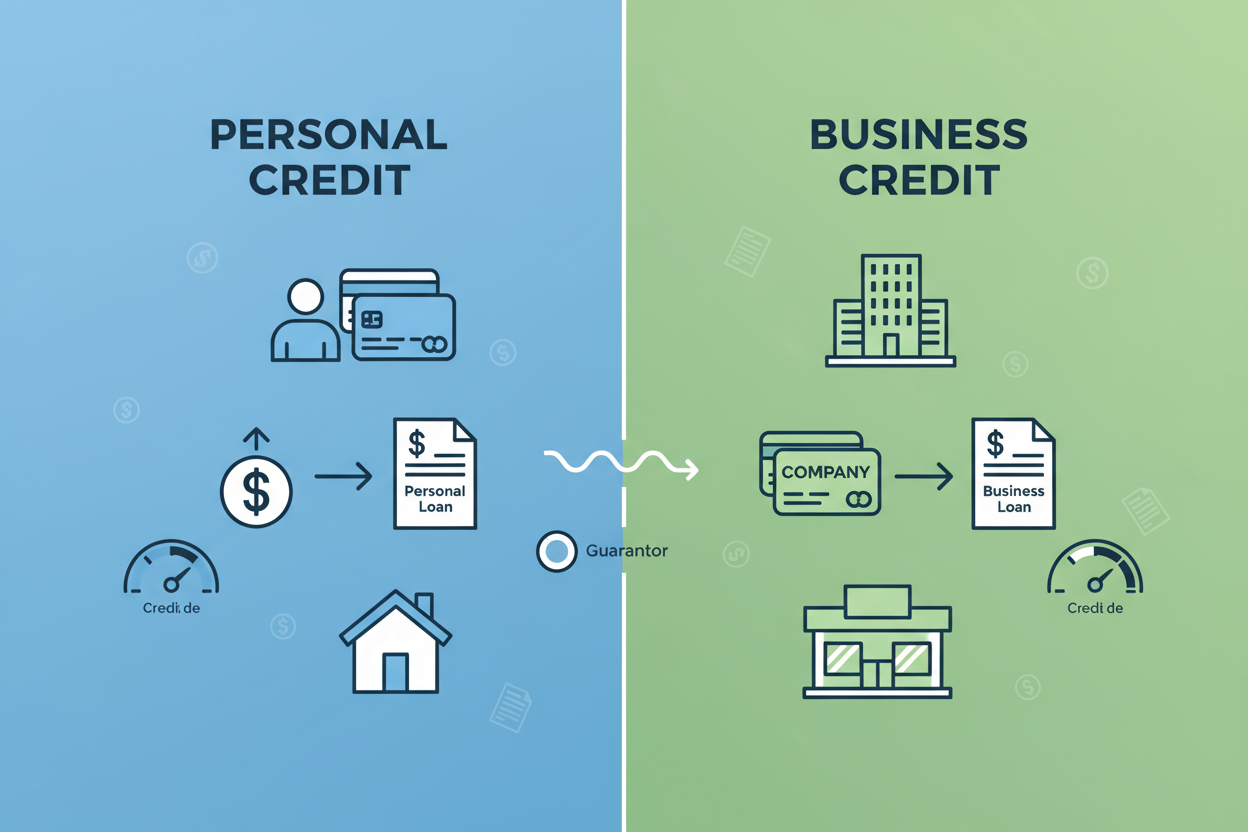

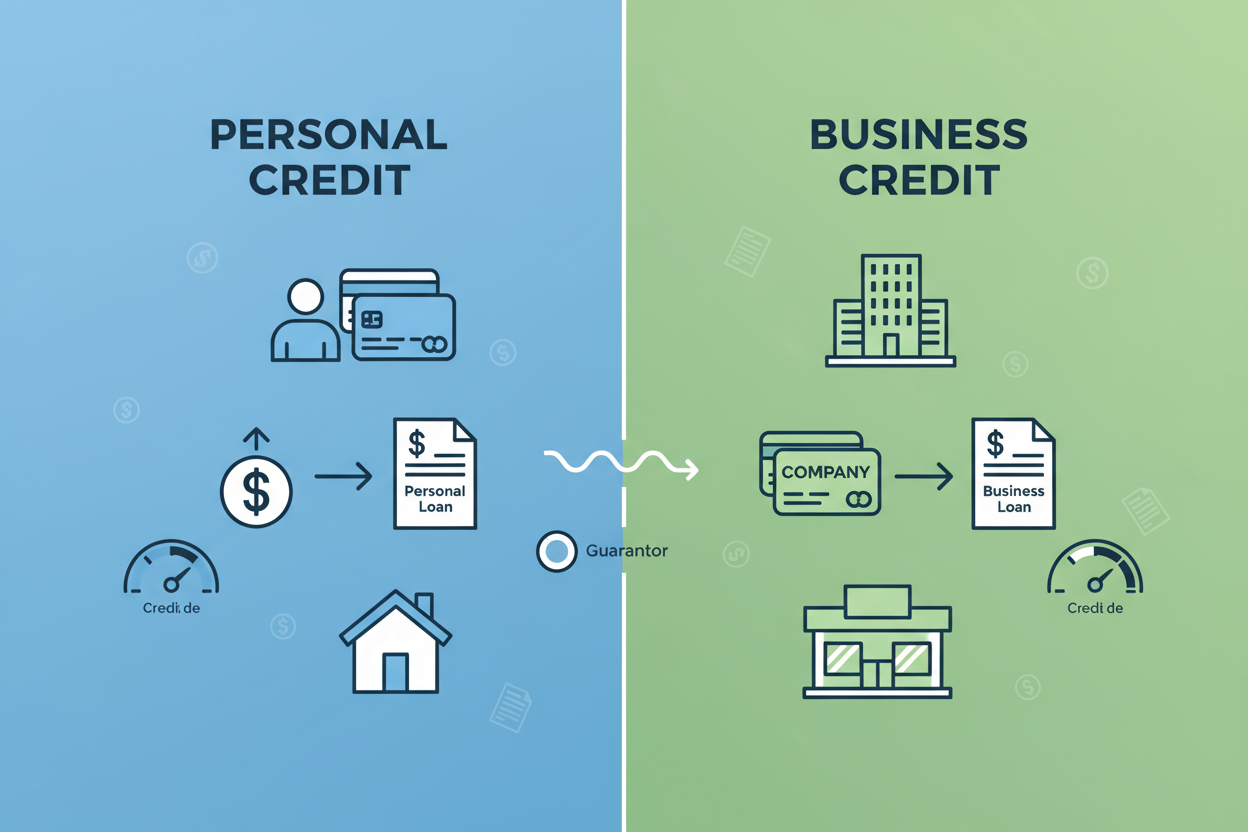

Personal Credit vs Business Credit

Check PersonalYour personal credit tells lenders how you manage money. Your business credit shows how your company handles it. Both are important, and when used strategically, they work together to unlock real financial power — from higher funding limits to better interest rates and trusted vendor relationships.

Having strong personal credit can make your first business credit applications smoother. Banks and lenders often check personal history for new business owners. If you’ve built a good relationship with multiple banks and shown you manage your personal accounts responsibly, they’re more likely to trust you and your company. Essentially, your personal reputation can open doors for your business.

Meanwhile, strong business credit separates your company from your personal finances. This means you can secure funding, net-30 vendor accounts, or equipment leases without risking your personal assets. Over time, as your business credit grows, it can even help strengthen your personal credit indirectly — because lenders see you as experienced at managing multiple financial profiles responsibly.

The key takeaway: building both is a strategic move. Personal credit lays the foundation. Business credit amplifies your opportunities. Together, they give you financial leverage that’s hard to beat.

👉 Start your $1 trial today and see the credit picture that lenders actually see.

-

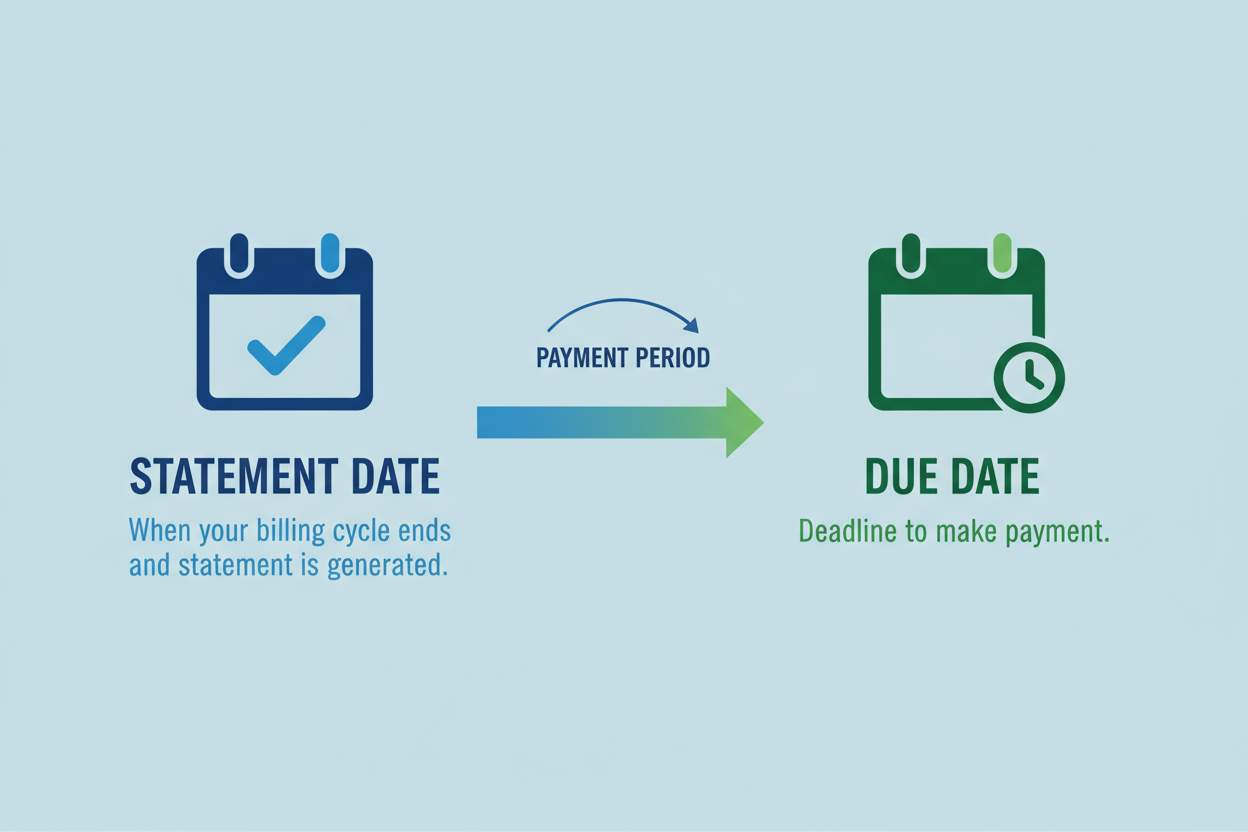

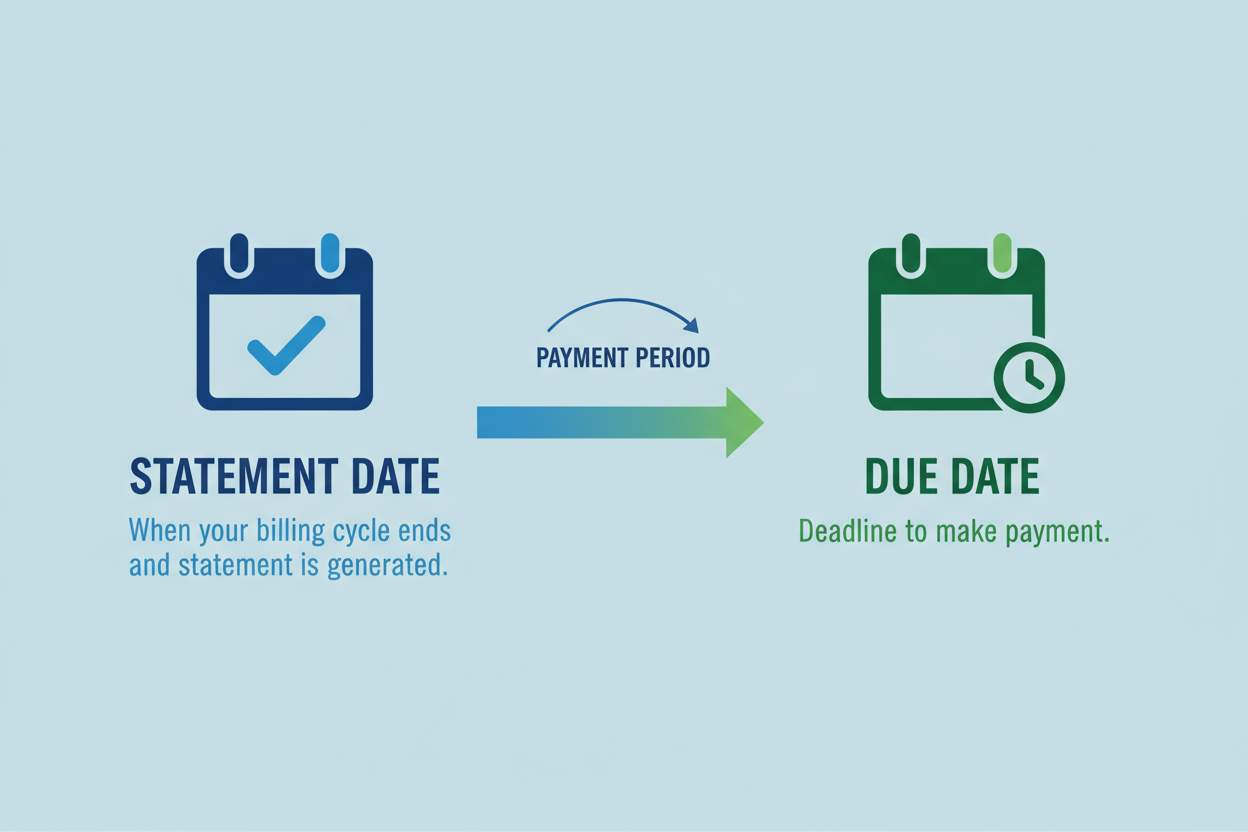

Statement Date vs. Due Date — Know the Difference, Build Real Credit Power

Your statement date and due date might sound similar, but understanding the difference can make or break your credit — both personal and business.

Statement Date: This is when your billing cycle ends and your balance gets reported to the credit bureaus. Think of it as the “snapshot day.” Whatever balance shows here is what affects your credit utilization — one of the biggest factors in your credit scores.

Due Date: This is your deadline to pay. Making at least the minimum payment by this day keeps your account in good standing and protects your payment history.

Here’s the trick: if you pay down your balance before the statement date, you show lower usage — which can boost both your business and personal credit scores faster.

For business credit, this strategy matters even more. Vendors, lenders, and business credit bureaus (like D&B and Experian Business) are watching how you handle payments and balances. Paying early can earn your business a stronger reputation and better funding offers.

Knowing when to pay is just as important as knowing what to pay.

-

Credit Utilization — The Hidden Score Booster

Credit utilization is the percentage of your available credit that you’re actually using. It’s one of the most important factors in both personal and business credit scores — and most people underestimate its impact.

For personal credit, experts recommend keeping usage below 30% of your total credit limit. For business credit, the goal is even lower — ideally under 10%. Low utilization signals to lenders that you’re responsible, reliable, and not dependent on borrowed money to operate.

Timing matters: paying down balances before your statement date, not just by the due date, ensures that the lower balance gets reported to credit bureaus. This simple habit can immediately improve your reported utilization, boosting your scores without any additional spending or risk.

There’s also a strategic angle: businesses with multiple accounts or lines of credit can rotate balances, keeping utilization low across all accounts. Coupled with strong payment history, this can rapidly build a business credit profile that attracts lenders, investors, and top-tier vendors.

By mastering utilization, you’re not just protecting your credit — you’re creating financial flexibility, unlocking higher limits, better rates, and stronger credibility for both yourself and your business.

DIY Credit E-Books

-

Credit Report Reset (30-Day Edition)

Regular price $12.99 USDRegular price -

DIY Credit Reset

Regular price $18.00 USDRegular price -

Inquiry Reset

Regular price $7.99 USDRegular price -

BOI: The Asset You’re Not Building (Yet)

Regular price $16.99 USDRegular price

Funding E Books

-

The Money Resource Vault: Verified Ways People Fund, Start, and Work”

Regular price $16.99 USDRegular price -

Off-Market Money: The Private Lenders Funding Quietly Every Day

Regular price $9.99 USDRegular price -

Fintech Loan For Startup Credit Reports

Regular price $15.99 USDRegular price -

List of Banks With No Hard Pull Ever

Regular price $15.99 USDRegular price$152.00 USDSale price $15.99 USDSale -

Micro Loan For New Credit

Regular price $15.99 USDRegular price

📊 Nav — Your Credit Health Partner

Monitor both personal and business credit in one place. Using our referral link gives you access to:

1.Enhanced credit monitoring

2.Business credit-building cards

3.Tools to separate personal & business finances

We earn a small commission when you sign up through our link — it helps us keep providing valuable resources while you take control of your credit.

Want To Educate Yourself In Your Field?

Click the link for over 6000 free courses